Imagine it's deflation and nobody cares

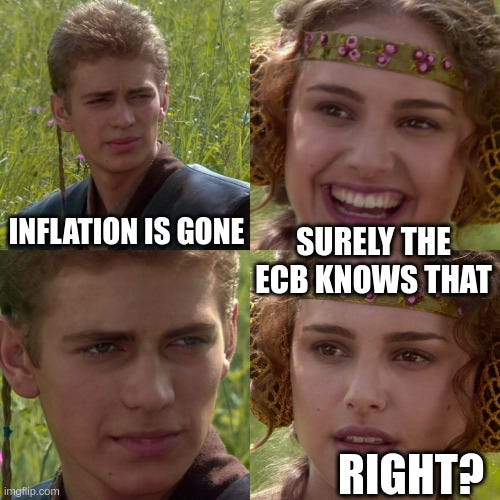

The German economy is sounding the alarm, but while inflation is disappearing the European Central Bank is reluctant. If only we could use the wisdom of the crowd.

The German economy is worried. They wrote an emergency letter to the government: conomy, climate, democracy - concerns everywhere. Inflation is not directly addressed in this letter, but it looms in the background. After all, it would be much easier for the state to take on debt if it could use freshly “printed” Euros. Unfortunately, the central bank refuses:

ECB President Christine Lagarde appeared a tad more courageous in Davos - but she sees no way to discuss interest rate cuts before the summer. “We are on the right path towards our inflation target of two percent,” said the ECB president. "But we haven't achieved it yet." And in a broadside to investors, she added: In the fight against inflation, it is “not helpful if expectations are far too high.” ECB chief economist Philip Lane sees it the same way. He doesn't believe prices will decline at the same rate and speed this year as last year. –Tagesschau, January 25th

Of course, Germany’s finance minister, Christian Lindner, can only sadly show his empty pockets. Ok, instead of pockets he might prefer to show charts of rising prices ... wait a moment ...

Hmhm. Inflation is practically gone for 10 months now–not completely gone, we want a little inflation of 2% after all. But even if we wanted stagnant prices: in December the price index was at 117.4 and in August at 117.5 according to Destatis. In other words, prices have not increased at all since August.

Ok, but Germany is not the EU and the ECB has to pay attention to the whole EU. So let’s take a look at the price index for the entire EU and see where “inflation becomes entrenched”.

It doesn't really look like it will settle at a higher level. Actually, we are already back to 2% (with fluctuations). The “prc_hicp_midx” index was at 127.95 in December and 128.11 in September, so prices have fallen since then.

Hmm, I'm not an economist. I'm probably making some stupid mistake and the real economists agree that the ECB is doing it right. Something something core inflation maybe?

I’m the only one, right?

Prices have been falling for six months, slowly but surely. Unfortunately, the journalists and the central bank haven't noticed this yet. -Maurice Höfgen

Who is this Höfgen? Economist and business manager. Currently working as a research assistant for financial policy in the German parliament.

Heiner Flassbeck, former State Secretary in the Federal Ministry of Finance, now retired, is even clearer:

If the ECB does not turn things around soon by cutting interest rates quickly and drastically, it will not reach its 2 percent inflation rate target, but the inflation rate will fall below this value. As in the 2010s, this will once again make it almost impossible for the ECB to provide positive stimulus to the economy because it cannot reduce interest rates well below zero.

But what can you do as an individual? It feels a bit like during Corona, when people kept despairing about how difficult it is for our system to recognize the truth. I wish we had an inflation prediction market so that the forecast was crowd-sourced. We could do so much more. This could then look like this:

Unfortunately, the ECB does not reveal how it arrives at its “data-based” analysis. This way, nobody can criticize anything directly. But with a prediction market it wouldn't be necessary. Instead, you could work with your own model and (if you dare) bet against the ECB.

One could go one step further with decision markets about interest rate to forecast the effects of different options.

The pressure from companies will grow. At some point politicians will join in and at some point the ECB will give in. Maybe they will be so surprised that the inflation rate even becomes a deflation rate?

When will we reach the 2% inflation rate in Germany? I think until March (50%) or April (70%).

Will there be deflation in the EU this year? I see the probability between 10% and 20%, because even the ECB is likely to counteract in panic at some point.

Another Mantic Monday on Astral Codex Ten.

For some more election prediction introspection, another issue of the Asterisk magazine just came out: Prediction Markets Have an Elections Problem.

Manifold elected “Multi-Binary” as their most impactful feature add in 2023.

At Metaculus the Joker wrote another notebook article: Forecast Factors: Drivers of Interstate Wars in the Modern World.

Probably until next week, inflationary readers! 😊