Decisions, marketwise

Forecasting is fun (for nerds like me). It can also be useful if you use it to guide your decision making. If it isn't obvious how, here I spell it out in two variants.

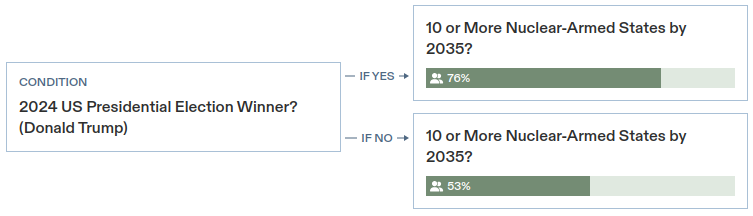

The previous post ended with a reference to decision making. The most direct input is asking for the outcome under condition of your choice. For example, US citizens might elect Trump for president again. One geopolitical aspect is how that will impact the number of nations with nuclear weapons.

Apparently, electing Trump raises this probability by 23%. Questions like these should be guiding voters; more than vague election promises at least. You still have to decide which aspects are most important to you. The number of nuclear-armed states is probably not your highest priority but maybe a Russia-NATO conflict?

Alternatively, Joint Markets

A fellow newsletter recently hosted a competition to promote an alternative to conditional markets, called “joint markets”. Unfortunately, I missed the launch of the competition but here are the results.

The general idea of joint markets is to list all possible outcomes as a multiple choice market instead. To reuse the Metaculus example above, I “translated” it:

The two approaches, conditional and joint, are equivalent. This should become obvious, if you visualize it as a decision diagram.

What I like about the joint markets approach is that the betting is easier. With conditional markets, the platform has to return the money for one branch. That means you should actually make some bets “for free” since some money is always returned. If it isn’t for free (current situation on Manifold), then participating means your money is trapped for a while and you pay opportunity costs.

On the other hand, for decision makers the conditional approach provides the information in a straightforward way. You can directly see the outcomes of your choices. With a joint market, you would have to sum up percentages.

Decisions are everywhere

So many decisions are made and predictions are behind every one of them. Elections are especially big this year but there are more:

If we legalize Cannabis, will there be fewer drug problems?

If our company develops product X, would that raise our stock price?

If player Y joins the team, will we win the championship?

If we switch to technology Z, will our metric A improve a month later?

If I only send this newsletter every other week, would I have fewer readers at the end of the year?

If we add this story to our Sprint backlog, will we finish it this iteration?

If we cast actor X, will that improve box-office numbers?

If we fire the CEO, would that raise our stock price?

If we hire Z, will they stay at the company for at least a year?

If we add this to our workload, will we still meet the deadline?

I want to see more of those. Metaculus seems to agree since they host a Conditional Cup this year. Manifold is looking for conditional markets too. The real money platforms don’t have such a feature.

The challenge is that such markets are harder to create and harder to forecast. Thus, there are fewer participants. We need more forecasters here. What would be the alternative?

Congratulations to Jake Gloudemans for winning the Quarterly Cup and thanks for writing about the experience. I’m plead guilty of point 9.

Probably until next week, my decisive readers! 😊